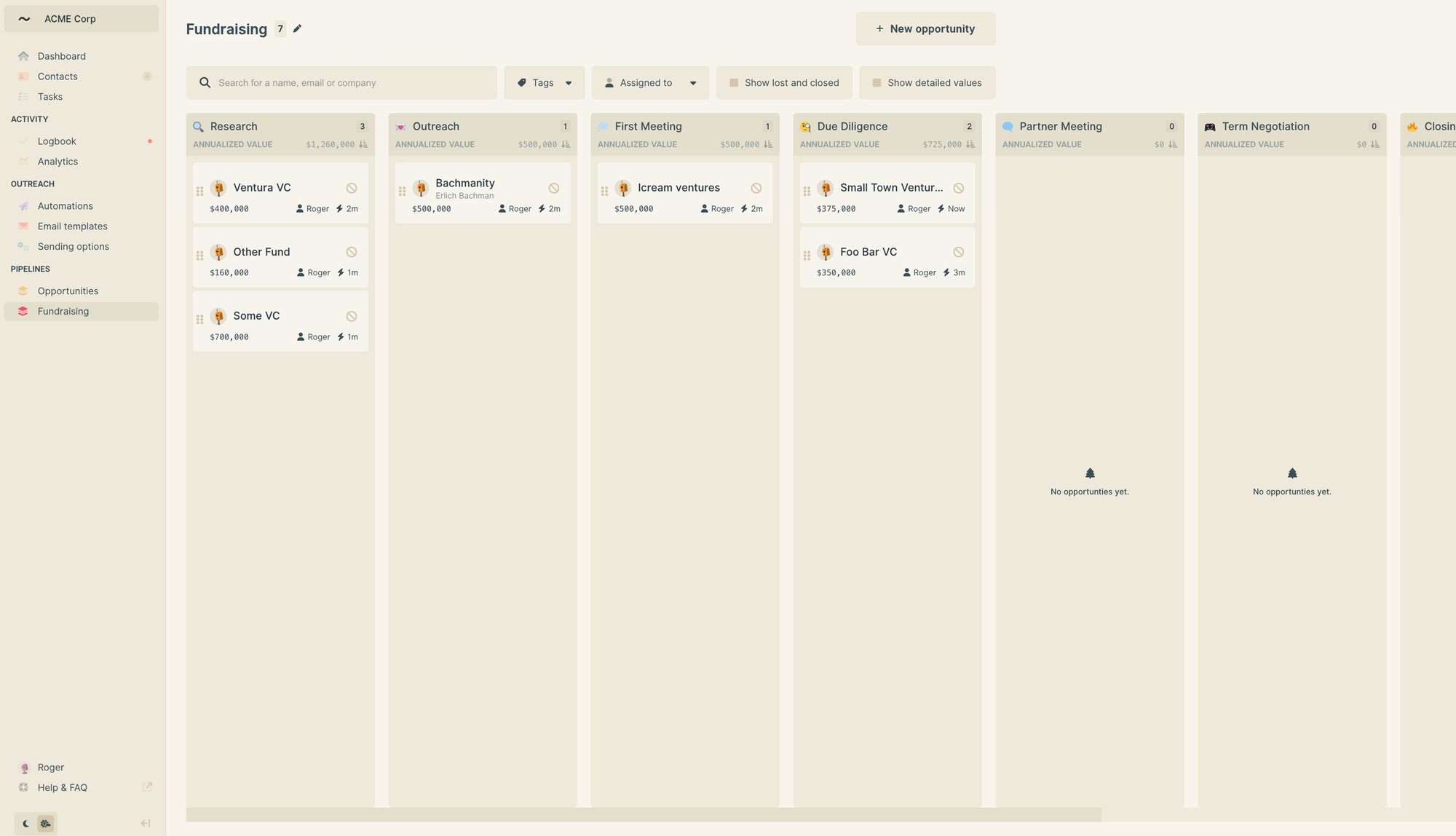

The ultimate fundraising pipeline template for startups: A systematic approach

As a startup founder, managing your fundraising process effectively can mean the difference between success and failure. A well-structured fundraising pipeline helps you track potential investors, maintain momentum, and close deals more efficiently. Here's a template tailored to help you organize your fundraising efforts.

Pipeline template: Essential pipeline stages for fundraising

1. Research & identification

- Purpose: Build a targeted list of potential investors

- Key activities:

- Research investors' portfolio companies

- Identify investment thesis alignment

- Check investment stage preferences

- Note recent investments and check dry powder availability

2. Initial outreach

- Purpose: Make first contact and gauge interest

- Key activities:

- Warm introductions (preferred)

- Cold emails with personalized context

- Conference or event connections

- Success metrics: Response rate, meeting conversion rate

3. First meeting

- Purpose: Present company overview and assess mutual fit

- Key activities:

- High-level pitch presentation

- Product demo if applicable

- Initial Q&A

- Next steps discussion

- Expected outcome: Clear next steps or fast no

4. Due diligence

- Purpose: Deep dive into business fundamentals

- Key activities:

- Detailed financial review

- Customer references

- Technical assessment

- Market analysis

- Team background checks

- Duration: 2-6 weeks typically

5. Partner meeting

- Purpose: Final presentation to investment committee

- Key activities:

- Full partner pitch

- Detailed Q&A

- Terms discussion

- Success metrics: Term sheet conversion rate

6. Term sheet & negotiation

- Purpose: Agree on investment terms

- Key activities:

- Term sheet review

- Legal consultation

- Negotiation of key terms

- Final agreement

7. Closing

- Purpose: Finalize the deal

- Key activities:

- Legal documentation

- Wire transfers

- Post-closing requirements

CRM Implementation best practices

Why you need a CRM

- Organized communication: Track all investor interactions in one place

- Follow-up management: Never miss important follow-ups

- Pipeline visibility: Get a clear view of your fundraising progress

- Team collaboration: Keep everyone aligned on investor communications

- Data-driven decisions: Analyze what's working and what isn't

Essential information to track

- Investor name

- Firm

- Investment stage focus

- Check size range

- Contact information

Additionally you also want to keep track of all tasks and follow-ups related to the contact, as well as pipeline stage, notes and comments.

CRM Recommendation

Wobaka is a simple CRM tailored for small businesses and startups. Setting up a fundraising pipeline is super easy and there's no limit on how many pipeline you can have. Staying on top of things is also a breeze thanks to tasks and reminders.

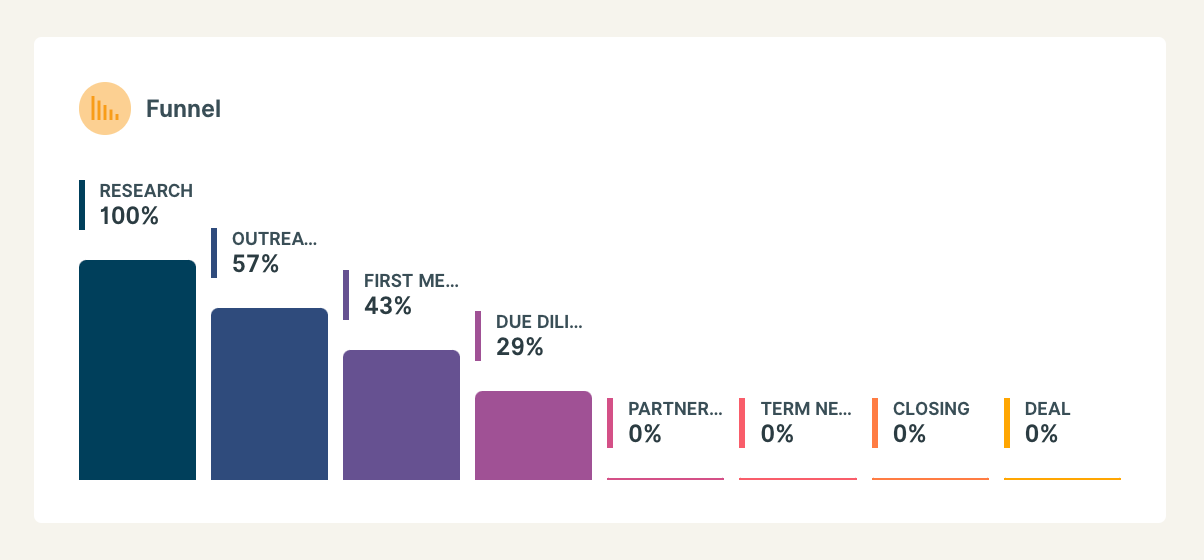

Wobaka also gives you simple analytics so you can easily track time in each stage, conversion between stages in your funnel, total pipeline value for each stage and meeting-to-term sheet ratio.

Best practices for pipeline management

Follow these best practices to manage your pipeline.

1. Regular updates

- Review pipeline weekly

- Update status and next steps quickly

- Schedule regular team sync on fundraising progress

2. Follow-up protocol

- Send meeting notes within 24 hours

- Schedule next steps before ending meetings

- Set reminders for follow-ups

- Keep communications consistent

3. Pipeline metrics to track

- Number of active conversations

- Conversion rates between stages

- Average time in each stage

- Total pipeline value

- Meeting-to-term sheet ratio

4. Common pitfalls to avoid

- Not maintaining regular communication

- Losing momentum with interested investors

- Poor documentation of meetings and next steps

- Focusing too much on low-probability leads

- Not having enough pipeline depth

Conclusion

A well-managed fundraising pipeline is crucial for startup success. By implementing this template and maintaining disciplined use of a simple CRM system, you'll be better positioned to run an efficient fundraising process and increase your chances of closing the right investors for your startup.

The key to successful fundraising isn't just about having the perfect system. It's also about consistent execution and follow-through. Start with this template, adapt it to your needs, and maintain the discipline to keep it updated throughout your fundraising journey.